From 100 Legends Way & 4 Pennsylvania Plaza to Wall Street.

In the third and final installment of this three-part interview series, 11-year NBA veteran and two-time champion Greg Kite takes us to his post-playing career and off-the-court endeavors.

If you missed part one, be sure to catch up here. If you want to read part two, check it out here.

Greg Kite P&T Interview, Part 3

After an 11-year NBA career that included two championships, Greg Kite quietly exited the league following the 1994-95 season. In the wake of his retirement, he transitioned into the finance sector, becoming a financial advisor.

His interest in business had been ignited during his playing days, and while with the Boston Celtics, he began laying the foundation for his post-career endeavors. “I took an internship and shadowed somebody I knew at one of the financial groups in Boston. I was very interested in money and how it worked.” When the Celtics traded Kite to the Clippers, however, that opportunity fell by the wayside.

After retiring from basketball, Greg Kite and his wife, Jenny, were already in the midst of raising their beautiful family of ten adopted children. Committed to providing the best opportunities for their children, Kite ventured into real estate and real estate development.

During the mid-2000s real estate boom, he connected with a financial services group in Atlanta, launching his career as an investment advisor. While acknowledging the importance of financial success, Kite emphasizes that true wealth encompasses far more than monetary gain, advocating for a holistic approach to life. “Everyone thinks about their stocks, bonds, 401K’s, real estate, and cash… but like the old country song goes, “There’s no luggage racks on hurses.” Kite emphasized, “You can’t take that stuff with you. What’s important for people is the wealth that comes from their foundational and intellectual wealth. Their friends, family, faith… their charities and their experiences. That’s what people really care about. So, when I work with people, my goal is to help people take that waddle out of their financial life so they can really focus on their aspects of authentic true wealth.”

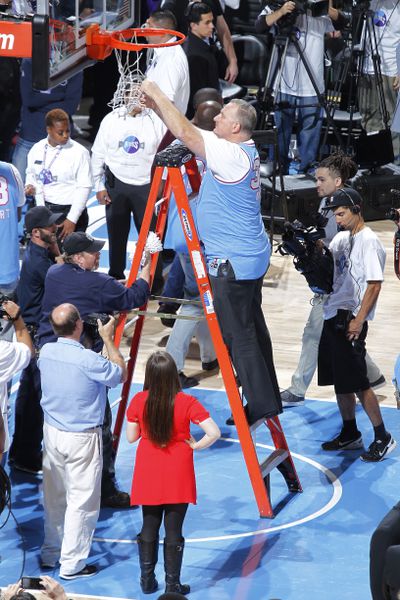

Photo by Brian Babineau/NBAE via Getty Images

As a financial advisor, Kite prides himself on taking a holistic approach with each of his clients. “I look at their whole financial picture.” Kite explained, “Some clients we do wealth planning, other clients we might just manage their money, and others might need annuities, insurance products, or a Medicare plan.” Rather than focusing on just one product or service, Kite takes the time to analyze each client’s unique situation and tailor a full financial plan around their short- and long-term goals and needs to help best his clients.

Today, Kite provides financial guidance to a diverse clientele, ranging from individuals approaching retirement to newlywed couples seeking to build their nest egg. “In general, individuals 55 and up are at the end of their careers making higher incomes, or have had longer times to save. Or they are getting in that retirement red zone, and they really need to do some things to protect and to plan.” Kite elaborated, “I also enjoy working with younger families. Particularly the ones who have got some things going right. They’re minimizing and getting rid of their debt, they’re putting away an emergency fund… and now they’re trying to save for the future and do something outside of their workplace retirement plan.”

As a former professional athlete, Kite is well aware of the all-too-common tale of athletes burning through their fortunes and ending up broke shortly after retirement. He explains that athletes’ earning power is essentially reversed. “Guys come into the league now earning seven-figure annual salaries right from the start, which is more than many people will make in their lifetime,” Kite said. “There are too many ‘oops, I wish I could have done that over again’ stories. But as individuals reach 40, 50, or 60 years old and are earning more, they tend to be a bit wiser with their money.”

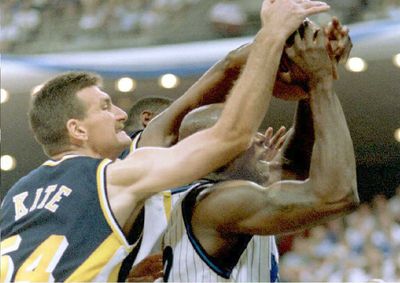

Photo by Rocky Widner/NBAE via Getty Images

One of the significant challenges athletes encounter when they suddenly acquire substantial wealth at a young age is a lack of financial education, irrespective of their background. “We’re not taught about it in school. Families don’t even talk about it. Suddenly, you’ve got all this wealth and a lot of people chasing you,” Kite said. “Whether it’s unnecessary things like six cars or $200,000 worth of jewelry, athletes often fall into those traps. They trust people who turn out to be untrustworthy and lose control of their finances, just like the Shohei Ohtani situation. That’s what I mean by its backwards. These athletes get a lot of money quickly, and they can blow through it.”

Kite underscored the elevated divorce rates among athletes, particularly following retirement, as a major contributor to their financial instability. “Some athletes aren’t very judicious, having children with multiple partners and taking on (multiple) child support payments. It’s a myriad of reasons. It’s unfortunate,” Kite said. “I know that the NBA and the Player’s Association do the best they can to educate and bring resources to guys to prevent that and help them avoid the predators.”

Kite discussed the inherent risks tied to the surge of substantial NIL deals for college athletes, particularly those recently reaching the age of 18. He emphasized that the sudden accumulation of wealth at such a young age heightens the probability of financial missteps, primarily due to a lack of experience and financial literacy. “The money is coming younger and younger with these NIL deals. Having some guidance, going slow and steady, and not do anything rash and put the money away in some plain and boring things.” Kite explained, “When you’re making that kind of money that far exceeds your budget, you’re able to save a much higher percentage of that, 50-80% of that, which is more than most people do typical salaries.”

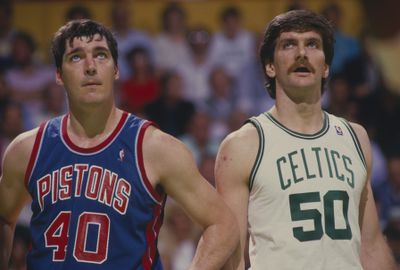

Photo credit should read TONY RANZE/AFP via Getty Images

Kite, who has a diverse clientele, also advises younger individuals and families who are just beginning their financial journeys and seeking to establish a solid foundation. He consistently offers the same guidance to these younger clients. “The starters are to stay out of debt, especially credit card debt. When you’re buying your first home most people are going to have to do a mortgage.” Kite further advises “Be careful with student loans. Staying out of debt, and not avoiding that debt snowball that you can’t get out of with unsecured debt especially.”

Kited notes, “Establishing an emergency fund is key. Think of (placing) money in a couple of different buckets. Money you might need in the short term or as an emergency fund. And then money for the long term that you aren’t going to touch until retirement. Then (another bucket) if you have some short-term goals, like a down payment on a house.” Kite went into common mistakes made by younger individuals. “I see too often people in their 30’s and 40’s who have a 401k plan, but then something happens. They may have just $500 or $1000 in savings, and shortly thereafter acquire credit card debt… or they go and tap into their long-term savings.” Kite explained one of the most important things for people to learn that is not taught in schools is the Rule of 72’s. “It’s how you calculate how compounding happens. The power of compound interest is phenomenal, you just have to let it go to work. The sooner that somebody can start saving, even if it’s $25 or $100 a month, start doing that now in your twenties.”

Kite often teaches this same lesson to his younger clients. “If somebody from the age of 20 to the age of 30 can save $500 a month and then stop saving, and then another person started at the age of 30 and saved until 65 and saved the same amount of money per month. If they were getting the same rate of return on that when they were 65, the person who started earlier, the person who started earlier and only saved for 10 years would have more money… it was Albert Einstein who said compound interest is the eighth wonder of the world.”

And no matter where Greg’s financial career takes him, as far as his celebrated 11-year basketball career goes, E will always = mc2 championships.

Photo by Focus on Sport via Getty Images